The chancellor recently announced fantastic support to VAT registered business with the deferment of paying VAT. To be clear this does not not change the charging of VAT on sales invoices, the claiming on purchases or the filing of the VAT return. This scheme has no impact on the payment on of Corporation tax or PAYE.

All it means is that the VAT payments due between 20 March 2020 and 30 June 2020 can be deferred until the end of the 2020/2021 tax year (presumably 5 April 2021).

For quarterly registered businesses this will mean the payments due as follows:

- on 7 April 2020 (for quarters ended 28 February 2020)

- on 7 May 2020 (for quarters ended 31 March 2020)

- on 7 June 2020 (for quarters ended 30 April 2020)

Businesses on annual schemes will be able to miss out all monthly payments between 20 March 2020 and 30 June 2020.

On the face of it this scheme is great but there is some devil in the detail.

Those businesses who pay by Direct Debit will continue to have their VAT payments collected despite the deferment. Therefore to take advantage of the deferment your must take action to cancel your direct debit at least a week before the due date.

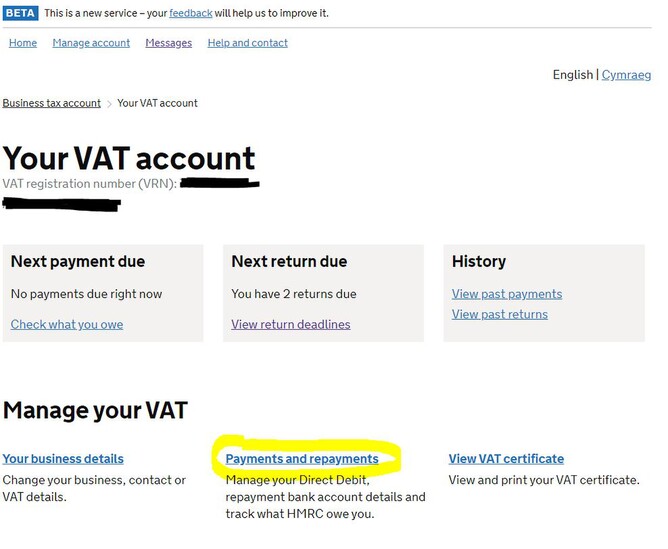

To do this you must log in your Business Tax Account with your usual long in details. Then click on View your VAT Account in the Making Tax Digital section. You will then be presented with a screen similar to that below.

Click on the Payments and Repayments section and then click on the VAT direct debit and follow the instructions to cancel. You will receive an e-mail from HMRC advising that the Direct Debit has been cancelled within a few minutes.