The Budget of huge change. Rachel Reeves delivered her first Budget for the new-ish Labour Government, notable as the first by a female Chancellor in the UK’s history.

Prior to the Budget there had been huge speculation about the content. Tax rises were expected, and the Chancellor delivered on that but possibly not quite to the extent expected in some areas.

However, it is clear we will all be paying more tax than before. Cynically it is not a surprise that the Government brings in the harder measures early in its term, with the political hope that they can make things easier later and closer to the next election.

Our fear is whether these tax rises, particularly for business owners, hinder the growth in the economy the Government so desperately needs to sort out the structural problems in the UK economy. On the other hand, Government spending will increase for Investment so certain sectors will benefit from that new expenditure.

This newsletter is a general summary of the measures – we will follow up with specific clients about measures that impact them in the coming weeks.

The full government statement can be found here:

https://www.gov.uk/government/topical-events/autumn-budget-2024

Key changes were as follows:

Income Tax

Allowances frozen to 2028 but will uprate by inflation from April 2028. Allowances have now been frozen since 2021, bringing more people into higher rates of tax.

National Insurance

No change to employee rates but significant rise to the employer rate to 15% (from 13.8%) plus a reduction in the free allowance from £9,100 to £5,000.

The government has increased the Employment Allowance from £5,000 to £10,500 to help small employers and is removing the £100,000 threshold, expanding this to all eligible employers.

Employers will need to factor these increased costs into their hiring decisions.

Capital Gains Tax

As expected, there were changes to the Capital Gains Tax regime.

The lower rate of Capital Gains Tax will rise to 18% from the current 10%. The higher rate will increase to 24% from the current 18%.

Capital Gains from Carried Interest will now be taxed at 32%.

The Business Asset Disposal Relief Lifetime allowance is maintained at £1m but the rate increases from the current 10% to 14% from April 2025 and 18% from April 2026. If you have a business to be sold soon or subject to a Members Voluntary Liquidation it may be tax wise to complete such a transaction prior to April 2025 to get the lower 10% tax rate.

Corporation Tax

No changes to existing rates, effectively 19% on annual profits to £50,000, 26.5% on profits between £50,000 and £250,000 and 25% on profits over £250,000.

Stamp Duty Land Tax

Rates maintained. Only change is to increase the Additional Dwellings Supplement (for 2nd homes or companies buying residential property) from 3% to 5%. This applies from 31 October 2024.

VAT

No changes other than the pre-announced VAT to apply to Private school fees.

Inheritance Tax

Rates and allowances maintained until 2030.

Inherited pension funds will now be subject to IHT.

Business Property Relief and Agricultural Property Relief reformed to introduce a cap of £1m of IHT free. Beyond that taxed at a rate of 20%, half that of other assets.

AIM shares currently qualifying for Business Property Relief will now be subject to a 20% IHT rate.

Non-Domiciled Tax status

Status effectively abolished. Moving to a residency system and domicile removed from the UK tax system from April 2025. Those clients living in the UK and relying on this exemption to avoid paying UK tax on overseas income should be aware that this income will now be subject to UK taxation.

Business Rates

Significant reliefs for Leisure, Retail and Hospitality businesses.

Private schools will lose their exemption from Business Rates.

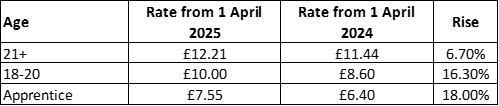

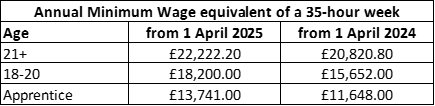

National Minimum Wage

It was announced just prior to the Budget that the National Minimum wage rates from 1 April 2025 would increase substantially and well ahead of wage rate inflation. The government also announced an aim to equalise the 18-20 rate with the 21 and over rate. Employers will need to carefully review their wage structure to ensure they do no fall foul of these new rates come 1 April 2025.

In addition to this, employers will face increased National Insurance costs (see above) plus increased employment rights from 2026 for employees in the Employment Rights Bill 2024 such as Statutory Sick Pay (funded by employers).

Please do get in touch with us if any of the measures above impact you or you would like further explanation on how they may impact you.